- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Success by sintering, part 2

While laser sintering looks like magic, it still requires a sound approach and rational expectations.

- By Jim Anderton

- November 24, 2014

- Article

- Metalworking

This Airbus part shows how organic shapes can be used for maximum strength with minimum mass using 3D technology

Few technologies are as widely touted or carry greater expectations than 3D printing.

The mass media almost daily reports news of dramatic breakthroughs in the technology, once restricted to plastics but now embracing metals, primarily through selective laser sintering [SLS].

On TV it looks like magic, but in the real world, progress from laboratory curiosity and prototyping technology to shop floor production process still requires planning and expertise.

The basic principles of laser sintering are easy to understand. A thin layer of a specially prepared metal powder is deposited on a base and a laser beam traces an outline of a very thin layer of the part, locally melting the metal powder and consolidating it into a mass. As successive layers are deposited and the laser traces the desired pattern again and again, a solid structure grows from the bottom up. It sounds simple, but there are two critical issues: resolution and density.

While it’s possible to control laser beam position very accurately, corners and edges can be a challenge, limited by properties of the metal particle spherules and properties of the microscopic molten metal pool.

Surface finish is similarly affected by the quality of the powder and the thickness of the deposited layers. More, finer powder layers produce high-resolution parts with better surface finishes, but require high-quality, highly engineered metal powders and much longer cycle times.

From a machining perspective, cycle times in additive manufacturing processes seem absurdly long. Complex parts can take tens of hours or days to complete, limiting the application of the technology to small parts that can’t be made with machine tools.

That limitation, however is also the key to the expected explosive growth of 3D printing in the future, the ability to make complex parts that simply can’t be made any other way.

At the current stage of technological development, SLS produced parts are frequently finished post sintering to achieve a desired surface quality.

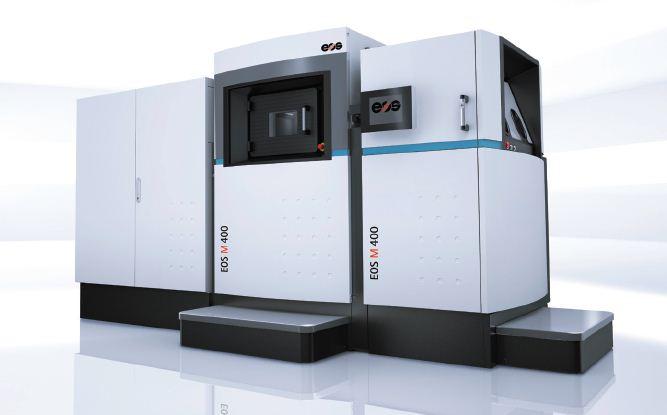

With a building volume of 400 x 400 x 400 mm, EOS M 400 allows the production of large metal parts on an industrial scale – directly from CAD data. A 1 kW laser allows for higher build rates and increased layer thickness. EOS offers an increasing number of metal materials for the EOS M 400 system www.eos.com

Frequently, this is not due to machine limitation, but the need to keep cycle times reasonable.

Large, complex and high-resolution parts can take days to fabricate using laser sintering, a slowness that would ordinarily condemn the process to strictly prototyping applications, but the ability to create hollow parts of complex internal structures, which are impossible to machine, makes it worth the wait for a critical applications. The potential for weight saving with great structural strength is obvious, and is the reason for high levels of interest in the aerospace community. Additively made metal parts have entered production, although at this point they’re limited to non-safety critical components such as panel hinges. General Electric will soon launch mass production of jet engine fuel nozzles using the technology, a considerable step forward and acceptance of laser sintered metal parts in safety critical applications.

From a process control perspective, there’s little in common with machining processes.

The raw material is as important as in machining in terms of composition, but selecting the right alloy is only half the battle with laser sintering.

The diameter of the powder particles must be carefully controlled and contamination rigidly excluded to produce fully dense, inclusion-free parts. The economics of the process restricts powder availability to high-value steels and non-ferrous grades, which are expensive. Recycling of unused powder is practical, but careful handling of the powder is essential, which may contain traces of partially sintered particles similar to weld spatter. User experience will guide the recycled versus new material ratio selection, although for very high value parts, virgin material may be the safest option. Machine vendors are the primary suppliers of raw materials; sourcing powder through them is one way to minimize trouble, especially if the machinery dealer has qualified a part on their equipment. The only other consumable of note in the process is the inerting gas, typically nitrogen or argon, both of which can be sourced from standard industrial suppliers.

Laser sintering is radically different from other part making processes; it’s issues are unique too.

According to John Manley, president of Machine Tool Systems and Canadian distributor of EOS machines, “The big concern everyone has in aerospace applications is melt pool monitoring. You’re creating internal hollows and voids. There’s no easy way to inspect a laser sintered part without destructive testing. How do you know you’ve built what you said you built? For conformal cooling channels it’s one thing, but for aerospace parts lives are at stake.”

Metal 3D processes will be limited to high-value parts at least initially, and the medical market is a natural target. Manley says, “It’s similar and in some cases more difficult than aerospace. The problem is how do you get the powder out that’s entrapped within the lattice work? In many cases it’s a trade secret. In applications such as hip implants, a few grains containing powder left inside the structure can migrate into the body and cause serious problems. It’s a complex problem; a small job shop isn’t going to simply buy a 3D machine and jump straight into the medical implant market.

We can now imprint structures that dramatically improve osteophyte integration using latticework structures with internal barbs and features that improve reliability and speed patient recovery. Certification is a challenge for biomedical and it’s a challenge for the finishing processes as well. Even powder handling is affected. With metal, whatever powder that doesn’t see the laser can be recycled. The problem with implant applications is the necessity to prevent cross contamination of metal powders entirely.

One grain of a foreign metal can fail a part.

Dedicated machines that run only one grade of powder are essential for approval for surgically implantable materials.”

For applications where cross contamination is a serious issue, the time needed for a thorough cleanout of the machine must be considered, along with a way to qualify the cleaning procedure. How do you test for cleanliness?

With machine time at a premium, one solution may be to use multiple machines with each dedicated to a specific material.

THE BUSINESS CASE FOR ADDITIVE

For rapid prototyping of parts, the business case for laser sintering already exists for many players, but production is inevitably slower to develop. Additive manufacturing in metals is slow, expensive and requires considerable expertise, a situation similar to the subtractive environment at the dawn of CNC equipment. Like that example, expect additive processes will become cheaper, faster and easier to use in the future. Right now however, does it pay to embrace the technology?

Mark Kirby, additive business manager for Renishaw Canada, has no doubt. Kirby refers to GE’s recent announcement of a major effort to produce fuel nozzles as an example: “For a company like GE, a half a percentage point improvement in engine fuel efficiency is huge...they’re a special case, where it’s justified to embrace the technology broadly.

We think of a three level process. Level 0 is a prototyping process. Barriers to entry are very low and it’s possible to create parts quickly. Level 1 is a replacement part application. In aerospace we’re seeing a lot of brackets, because they have redundancy and it’s possible to go back to the previous design at will; they’re usually not safety critical.

A Level 2 application still allows substitution of a machined or forged part, but takes advantage of the capabilities of 3D; at Level 3 the user has fully embraced the technology and has consolidated parts and created complex internal structures. It’s one of the great capabilities of additive processes.”

Do we know where the opportunities are in Level 3 applications? “We’re still scratching the surface”, states Kirby. At the Level 3 application, you’re taking full advantage of the technology, but there is risk. In Formula One racing, for example, critical parts like roll bar assemblies are now produced additively.”

If Formula 1 drivers literally bet their heads on the technology, capability isn’t a question. For firms looking to 3D as a profit centre, however there are questions aplenty.

While the technical risk is manageable, the financial risk for firms embracing 3D can be mitigated in several ways. One is to begin with additive manufacturing services on a contract basis, although this does little to help the user down the process learning curve. Another is to source the equipment from a vendor who has the ability to help develop and qualify a part with in-house technical resources. This is the most cost-effective way to get the equipment up and running quickly, as well as mitigating risk when producing the all-important first part for a new additive customer.

The technical and financial issues are many, but they’re a known quantity. With major OEMs behind additive manufacturing and considerable interest from high-value part user segments like aerospace and surgically implantable materials, in time additive will be ubiquitous. Canadian Metalworking will have much more coverage of this growing segment in the months to come.

About the Author

subscribe now

Keep up to date with the latest news, events, and technology for all things metal from our pair of monthly magazines written specifically for Canadian manufacturers!

Start Your Free Subscription- Trending Articles

Identifying the hallmarks of a modern CNC

Tooling for spot facing and counterboring is completely customizable

CTMA launches another round of Career-Ready program

Collet chuck provides accuracy in small diameter cutting

Sandvik Coromant hosts workforce development event empowering young women in manufacturing

- Industry Events

MME Winnipeg

- April 30, 2024

- Winnipeg, ON Canada

CTMA Economic Uncertainty: Helping You Navigate Windsor Seminar

- April 30, 2024

- Windsor, ON Canada

CTMA Economic Uncertainty: Helping You Navigate Kitchener Seminar

- May 2, 2024

- Kitchener, ON Canada

Automate 2024

- May 6 - 9, 2024

- Chicago, IL

ANCA Open House

- May 7 - 8, 2024

- Wixom, MI