- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Political uncertainty, economic stability?

Sovereignty politics grip Québec during a critical provincial election.... will industry be affected?

- By Jim Anderton

- January 1, 2015

- Article

- Management

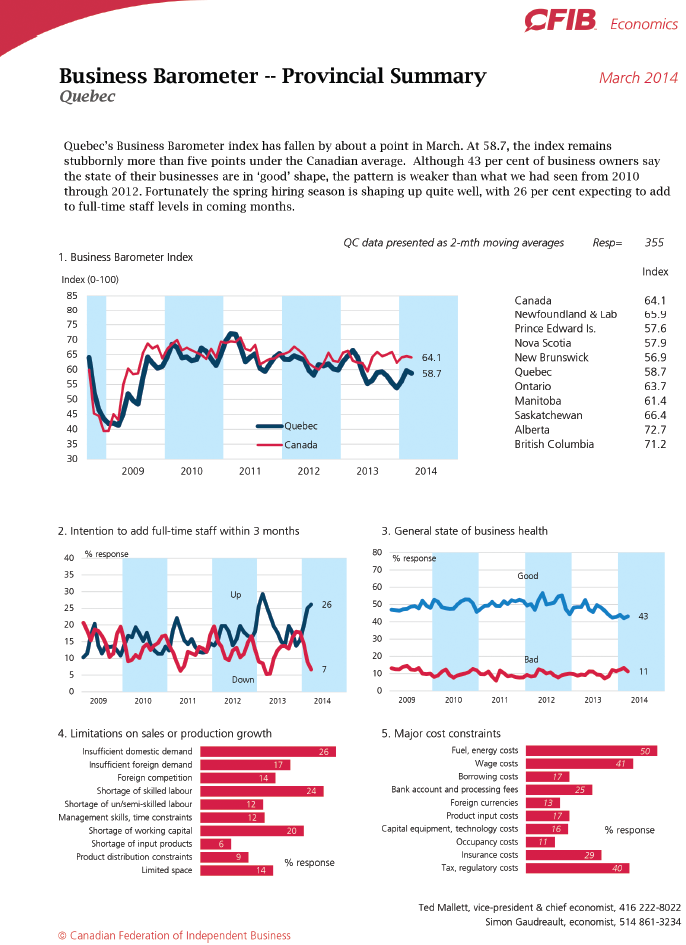

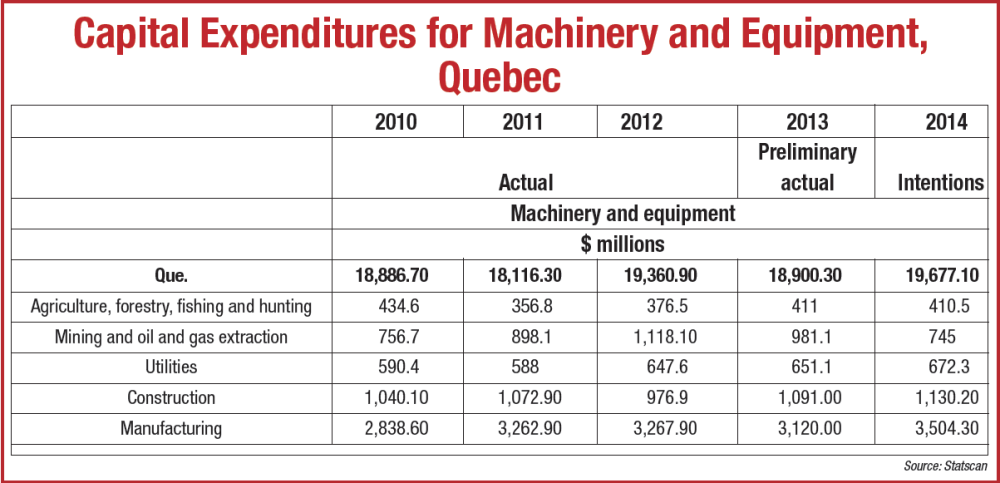

Government support and investment intentions send economic signals, but there’s no substitute for hard data, particularly capital expenditure on production machinery and equipment. This StatsCan chart shows modest overall growth in capital expenditure, with a noteworthy decline in mining and oil and gas extraction spending as well as static growth in the ag/forestry/fishing and hunting sector. Construction is up slightly, but the star is clearly manufacturing with 2014 predictions showing growth approaching 15% over 2013 numbers, reversing the downtrend over the relatively flat 2011/2012 figures. With aviation and auto booming, and strong demand for resources such as aluminum, the province should enjoy stable growth in the manufacturing sector for 2014.

It said that nature abhors a vacuum, but in business there is no question about it: business abhors uncertainty. Unfortunately, new developments in this year’s Québec provincial election have again stirred the sovereignty issue, with unknown consequences for the business environment in La Belle Province.

2013 economic performance in the province underperformed according to the Québec Ministry of Finance 2013 economic and financial update released at the end of November. The report points to increase household saving and proportionately decreased spending, depressing retail sales and new home starts which were down by nearly 22 per cent year-to-date in October. Exports however, rose by 4.5 per cent year-over-year, driven by strong commodity, auto and aerospace sector performance, which suggests that anemic growth is entirely due to weak domestic consumption. According to the RBC Economics Provincial Outlook, December 2013, senior economist Robert Hogue expects a better 2014, mainly because of currency and export demand issues: “We expect further advances in exports in 2014, supported by growing US demand and a modestly weaker value of the loonie. It will be developments on the domestic side that, we believe, will add more to growth, however. First we expect less housing construction drag because housing starts have much more limited downside left in them after slow-to-12-year lows in 2013. Second, signs that job creation resumed in the fall of 2013, following substantial losses during the first half of the year, will set the stage for stronger household spending in 2014.

"And third, the economic stimulus plan announced by the provincial government in October (with an array of measures totaling $2 billion over four years) will begin to contribute slightly to growth in 2014."

A stimulative provincial fiscal policy is always a significant factor, and in an election year program spending promises are a given. Spending however, has deficit implications in the medium to long term; the provincial government expects deficits of $2.5 billion in 2013-2014 and $1.8 billion in 2014-2015, and the accumulated debt will make it very difficult for the province to ameliorate the effects of the recession into 2016, especially with the major parties’ commitment to control government spending.

But will the recession continue? With Québec exports leading the way and now solid signs of recovery in the U.S., the combination of high-tech manufacturing, particularly in the aerospace sector, and recovering global demand for raw materials brightens the long-term outlook considerably. An example is the recent agreement between U.S. aluminum producer Alcoa and the Government of Québec to update Alcoa’s three smelters in Québec, securing approximately 3,000 jobs. Under the agreement, Hydro-Québec will renew Alcoa’s power supply contracts for the Becancour and Deschambault facilities until 2030 and for the Baie-Comeau plant through 2036.

The agreement includes $250 million of planned investments at the smelters over the next five years and as part of that investment, Alcoa will increase production of aluminum used for auto manufacturing and reduce production of commodity-grade aluminum at the Baie-Comeau cast house to capture increased demand from automakers for the light metal. According to automakers, aluminum body sheet content in North American vehicles is expected to quadruple by 2015 and increase tenfold by 2025, from 2012 levels.

2014-2015: ALL ABOUT JOBS

Integration of government into the manufacturing and other sectors is historically high in Québec, driven both by powerful unions on the Left and nationalist politics on the Right. While English-speaking Canada tends to regard the province as a single economic entity, internally, provincial government support for economic growth is targeted, both in urban and rural districts, says Québec Minister of Finance and the Economy, Nicolas Marceau. “Québec’s economic performance depends directly on the growth of each of its regions. By focusing in particular on measures supporting investment, all of Québec’s regions become wealthier.

Quebec’s economic performance depends directly on the growth of each of its regions ... by focusing on measures that support investment all of Quebec’s regions become wealthier.

The scope of the actions brought forward in recent months is a good indication of the government’s commitment to develop their full potential,” the Minister said, during tabling of the 2014–2015 budget. Québec government support of private investment in the regions includes targeted initiatives for the forest and oil sectors, a tax credit for investments with higher rates in the resource regions, measures for the development of Northern Québec and steps to promote tourism.

“Since last October, the Québec government has contributed to $1.8 billion of private investment projects in the resource regions. These initiatives will help create or maintain roughly 2500 direct jobs,” the Minister noted. The plan includes allowing the Capital régional et coopératif Desjardins (CRCD) to issue $150 million in shares throughout 2014 targeting the financing of Québec cooperatives and SMEs, especially those located in the resource regions. Regional disparities in economic growth are addressed by small business support and financing programs that are regionally driven and designed for local conditions.

Local development centres, providing financing through local investment funds, are regarded as essential for supporting regional entrepreneurship, and under prebudget terms, local investment funds (LIFs) were set to expire on December 31, 2014, leaving local development centres (CLDs) without a financing function as of January 1, 2015. The budget includes plans to defer repayment of local investment funds for additional five years maintaining CLD activities in the regions, allowing them to make additional investments of $25 million through 2020 without recapitalizing the programs.

In Québec’s major cities, stimulus is driven by public works programs; the government plans to spend $125 million for four major capital projects in Montréal and significant spending on tourism driven cultural projects in Québec City, including a new indoor ice facility, although the government has not stated a direct intent to use the program to support an NHL franchise in the city.

PQ MAJORITY? IT’S DIFFERENT THIS TIME

At press time, Parti Québécois leader Pauline Marois clung to a small lead in popular support, but was threatened by a resurgent Liberal Party. Although the election call by the PQ was based on a proposal to limit overt expressions of religious affiliation in government, the message has deflected the Liberal Party strategic use of the sovereignty issue in their campaign, and the emergence of PQ superstar candidate Pierre Karl Péladeau.

While Marois has repeatedly stated that referendum was not in the cards in the short or medium term after a PQ majority victory, when pressed she did state that a sovereign Québec would retain the Canadian dollar and hoped for a seat on the board of the Bank of Canada. Further, she expected that an independent Québec would have no formal border control with the rest of Canada. The currency issue is a serious problem for the PQ. Retention of the Canadian dollar would calm investor sentiment and prevent a capital flight to Toronto as happened with the victory of the Rene Lévesque-led PQ government, but retention of any influence at the Bank of Canada, let alone a seat on the board, would be unlikely, leaving Québec with no way to influence monetary policy — something critical for an export — driven economy. And from a national debt standpoint, if that was apportioned per capita, Québec would have a debt to GDP ratio approaching 90%, debt which would be serviced with a currency outside their control.

Several commentators have warned that the situation could be similar to that of Greece within the E.U. Conversely, a new Québec-only currency would almost certainly be traded at a significant discount to both the Canadian and US dollars, potentially boosting exports especially of raw materials, but collapsing consumer purchasing power, an outcome politically impossible to a government.

With Aboriginal land claim issues in Québec’s North an unresolved and highly contentious issue, few believe that a PQ victory will lead to radical political changes in the short or medium term, you would be mistaken.

The emergence of Québecor media magnate Pierre Karl Peladeau was clearly intended to add star power and business credibility to a PQ platform that has historically been left-leaning. The effect however, has been to overshadow Pauline Marois and create considerable internal dissent from the party’s left wing and affiliated union supporters. The result has been an election campaign that, while politically volatile, isn’t expected to have a major impact on the manufacturing sector in Québec, regardless of the outcome.

About the Author

subscribe now

Keep up to date with the latest news, events, and technology for all things metal from our pair of monthly magazines written specifically for Canadian manufacturers!

Start Your Free Subscription- Trending Articles

Sustainability Analyzer Tool helps users measure and reduce carbon footprint

GF Machining Solutions names managing director and head of market region North and Central Americas

Mitutoyo updates its end-user portal

Enhance surface finish with high-speed machining

Portable 3D scanners offer adjustable scanning distance, advanced volumetric accuracy

- Industry Events

Automate 2024

- May 6 - 9, 2024

- Chicago, IL

ANCA Open House

- May 7 - 8, 2024

- Wixom, MI

17th annual Joint Open House

- May 8 - 9, 2024

- Oakville and Mississauga, ON Canada

MME Saskatoon

- May 28, 2024

- Saskatoon, SK Canada

CME's Health & Safety Symposium for Manufacturers

- May 29, 2024

- Mississauga, ON Canada